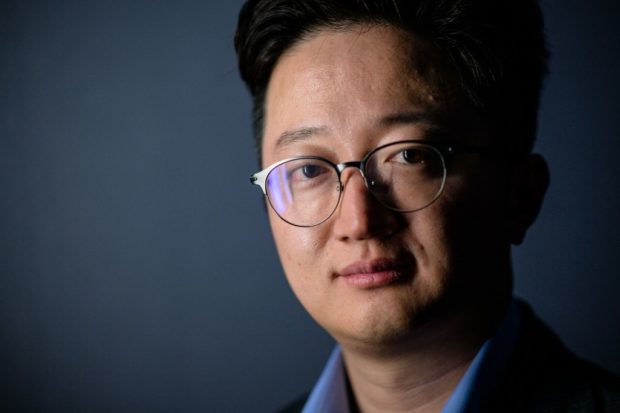

In this photo taken on March 6, 2023, Lee Chang-hwan, a South Korean activist investor, whose fund Align Partners bought a one percent stake in SM Entertainment, one of South Korea’s leading music companies which helped bring K-Pop to the world, poses during an interview with AFP in Seoul. (Photo by Anthony WALLACE / AFP) / TO GO WITH: SKorea-entertainment-economy, FOCUS by Kang Jin-Kyu

SEOUL, South Korea—It is the kind of K-drama that rivets millions of viewers—bitter boardroom battles, expensive lawyers, hostile takeover claims and high-stakes shareholder meetings.

Except this is playing out in real life as the godfather of K-pop fights his nephew for control of the music company he founded.

It features HYBE, the agency behind the smash-hit group BTS, and tech giant Kakao in an A-list battle that could also determine the billion-dollar industry’s future.

And it was triggered largely by one man: South Korean activist investor Lee Chang-hwan.

Lee’s fund Align Partners bought a one percent stake early last year in SM Entertainment, one of South Korea’s leading music companies that helped bring K-pop to the world, managing early hit groups such as boy bands Super Junior and SHINee.

He used that stake to argue for corporate reform, saying that SM founder Lee Soo-man—the so-called Godfather of K-pop—was, in effect, syphoning off millions of dollars every year in bogus consulting fees.

“It didn’t make sense,” Lee Chang-hwan told AFP in a recent interview, saying the money—six percent of publicly listed SM Entertainment’s sales every year—was paid to a private entity called Like Planning, which was entirely owned and controlled by Lee Soo-man.

The 36-year-old self-made investor, who was raised by a single mom and first shot to public attention by winning a popular South Korean TV quiz show, started asking uncomfortable questions.

Lee Soo-man’s pet company had raked in “nearly 160 billion won ($120 million) over the past 20 years”, he said, as SM risked major financial and reputational damage due to the behavior of its founder.

Creating K-pop

Lee Soo-man not only created individual K-pop bands in the 1990s such as H.O.T. and S.E.S., whose success arguably laid the groundwork for the stratospheric rise of groups like BTS and BLACKPINK, but also came up with the industry’s whole modus operandi.

He pioneered an obsessive level of training and micro-management of “idols”—trained K-pop stars—and his idea of combining strong visual performances and aggressive overseas marketing helped make SM Entertainment an industry behemoth.

He founded the company in 1989 and took it public in 2000—so he was predictably outraged last year when SM Entertainment’s management, including his nephew, agreed with activist investor Lee Chang-hwan’s assessment and moved to terminate the “unfair” deal with Like Planning.

In an apparent fit of revenge, Lee Soo-man sold the majority of his stake in SM—14.8 percent of the company—to one-time rival HYBE, the agency that manages BTS, for $325 million.

The move made HYBE the single largest shareholder in SM Entertainment, prompting outraged protests from SM’s management that it was a hostile takeover that would create an HYBE monopoly and damage the K-pop industry’s massive potential.

In a bid to wrest back control, SM’s management brought in South Korea’s Kakao, a sprawling cash-rich tech conglomerate that owns the country’s most popular messaging app. Kakao is now seeking to buy a controlling share of the company to block HYBE.

‘Valley of death’

The feud has unleashed a family succession drama, with founder Lee’s nephew, Lee Sung-su, who is the company’s CEO, taking to YouTube to air their dirty laundry.

Accusing his uncle of tax fraud using overseas companies, he demanded the elder Lee “kneel down and apologize” for his alleged crimes.

“Sir, please stop now… It is the only way to save you from the Valley of Death,” he said in a video posted online.

Lee Soo-man has not responded to his nephew’s allegations, and could not be reached for comment by AFP, but Yonhap reported he has said Lee Sung-su is a “good nephew” and that his “heart aches” due to the feud.

Experts say the drama is an illustration of a perennial problem in South Korea’s dynastic chaebols: founding families exerting control through a complex web of crossholdings, allowing them to wield unchecked power despite not holding controlling shares.

The chairman of South Korean giant Samsung Electronics, who was also the heir of the founding family, was convicted and jailed in 2017 over corruption, although he was given a presidential pardon last year.

Align Partners’ Lee Chang-hwan says the SM Entertainment case is similar.

“It was a bad example of a person who runs the company as if it’s his private entity… Whether it was legal or not, it is hard to accept as a shareholder,” he said.

Lee Chang-hwan also opposes HYBE’s bid for control, saying their efforts to create a monopoly bode ill for the market.

“We thought there was great potential for further K-pop growth,” he said, adding he first started looking at investing in the industry in early 2021.

“BTS was already a huge success and we witnessed the formation of a real K-pop fan base in North America and Europe,” Lee Chang-hwan said. SM Entertainment was “undervalued” due to its management woes, he said, and seemed a good target. /ra

RELATED STORIES:

BTS’ agency HYBE becomes top shareholder of K-pop rival SM Entertainment

SM, Hybe dispute snowballs over Lee Soo-man tax evasion allegation

What is actually going on with SM Entertainment, HYBE, and Kakao?